Compound (COMP)

Compound is a decentralized finance (DeFi) project that facilitates lending and borrowing through smart contracts. Built on the Ethereum blockchain, it operates under the governance of the COMP token.

Overview

The Compound platform primarily serves two types of users: lenders and borrowers. Lenders can deposit their cryptocurrency tokens to earn interest, while borrowers can use their cryptocurrency as collateral to secure loans. The interest rate is influenced by the market's liquidity, and lenders earn COMP tokens based on the cTokens held in their wallet. The platform supports borrowing in various cryptocurrencies up to the collateral value posted by the user.

Compound v2

Compound v2 is a decentralized interest rate protocol on the Ethereum mainnet. It enables lending and borrowing of digital assets like ETH, 0x, Augur, BAT, DAI, and USDC with variable interest rates.

Compound III

Compound III is an EVM-compatible protocol that allows users to supply crypto assets as collateral to borrow a base asset. It offers USDC borrowing using ETH, WBTC, LINK, UNI, or COMP as collateral. The model reduces liquidation risks and fees, enhancing borrowing capacity.

| Ticker | COMP |

| Category | Decentralized Finance (DeFi) |

| Website | https://compound.finance/governance/comp |

| @compoundfinance | |

| Contract Addresses | |

|---|---|

| ethereum | 0xc0...88 Copied! Copied! |

| base | 0x9e...e0 Copied! Copied! |

| near-protocol | c0...ar Copied! Copied! |

| polygon-pos | 0x85...5c Copied! Copied! |

| arbitrum-one | 0x35...de Copied! Copied! |

| harmony-shard-0 | 0x32...58 Copied! Copied! |

| avalanche | 0xc3...37 Copied! Copied! |

| binance-smart-chain | 0x52...e8 Copied! Copied! |

| energi | 0x66...63 Copied! Copied! |

| sora | 0x00...2c Copied! Copied! |

Compound Treasury

Compound Treasury, in collaboration with Fireblocks and Circle, provides a platform for large USD holders to access USDC market interest rates. Accredited institutions can borrow USD or USDC using Bitcoin, Ether, and ERC-20 assets as collateral, with flexible repayment terms.

cToken

cTokens are ERC-20 tokens representing user deposits in Compound. When users deposit ETH or other ERC-20 tokens like USDC, they receive equivalent cTokens that earn interest. cTokens can be redeemed for the original token with accrued interest. The Comptroller manages risk by determining collateral requirements and liquidation eligibility.

Liquidity mining

Liquidity mining incentivizes users to contribute to the platform's liquidity pool. Users earn cTokens upon depositing cryptocurrency, which can be used as collateral for loans while accruing interest.

COMP Token

On June 15, 2020, Compound launched its governance token, COMP. The token is distributed across various markets based on interest accrued. It allows holders to participate in governance decisions and delegate voting rights.

Utility

COMP tokens empower users to influence protocol governance. Holders can vote on platform rules, while non-holders can be delegated voting rights for specific issues.

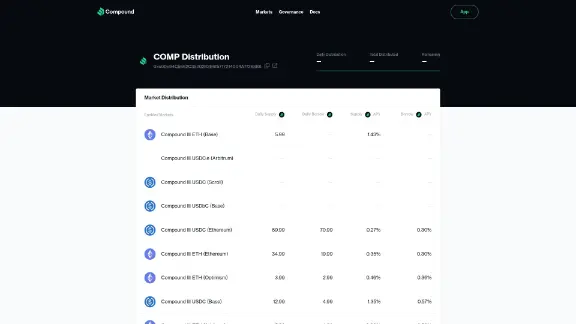

COMP distribution

Initially, 10 million COMP tokens were allocated, with 775,000 reserved for community governance initiatives. Distribution methods included Coinbase Earn and direct transfers to the Reservoir contract. Over half of the total supply, 5,004,949 COMP, is designated for community distribution.

Coinbase Pro

Coinbase Pro listed the COMP token on June 25, 2020. This listing significantly increased Compound's market capitalization.

Team

- Jayson Hobby - CEO

- Geoffrey Hayes - CTO

- Torrey Atcitty - Director of Engineering

- Jared Flatow - VP of Engineering

- Mykel Pereira - VP of Product

- Adam Bavosa - Developer Relations Lead

- Kevin Cheng - Head of Protocol

- Josiah Gulden - Head of Design

- Joseph Lih - Director of Marketing

- Coburn Berry - Software Engineer

Funding

Compound has raised $70.8 million across four funding rounds. Key investors include Andreessen Horowitz, Bain Capital Ventures, and Polychain. Funding efforts include a seed round, Series A, Coinbase's USDC Bootstrap Fund, and a substantial Debt Financing round in 2022.

Security incident

On December 29, 2023, the Compound Finance X account was compromised, leading to a phishing scam. The account was recovered the following day, and the team resumed control, removing the misleading messages and thanking the community for its support.