Tokemak (TOKE)

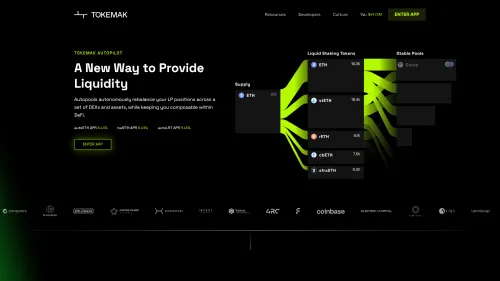

Tokemak (TOKE) is an ERC-20 token operating on the Ethereum blockchain, designed to revolutionize liquidity provision in the decentralized finance (DeFi) space. As a decentralized liquidity providing and market-making protocol, Tokemak aims to create efficient and sustainable liquidity across various DeFi platforms.

The role of TOKE in the Tokemak ecosystem

At the heart of the Tokemak protocol is its native token, TOKE. This token serves as tokenized liquidity, allowing stakers to direct the protocol’s total value locked (TVL) as liquidity across different DeFi markets. Initially, this includes popular decentralized exchanges (DEXs) such as SushiSwap, Uniswap, Balancer, and 0x.

TOKE as a liquidity mining tool

| Ticker | TOKE |

| Category | Decentralized Finance (DeFi) |

| Website | https://www.tokemak.xyz/ |

| @TokenReactor | |

| Contract Addresses | |

|---|---|

| ethereum | 0x2e...94 Copied! Copied! |

TOKE acts as a mechanism for liquidity mining, enabling holders to participate actively in the protocol's governance. Known as Liquidity Directors, TOKE holders can influence how the protocol's TVL is allocated across various DeFi markets. This capability allows them to optimize liquidity distribution and ensure efficient market-making practices.

How Tokemak optimizes liquidity

Tokemak is designed to address liquidity fragmentation within the DeFi ecosystem. By providing a unified platform for liquidity allocation and management, Tokemak ensures that liquidity is utilized in the most effective manner possible. The protocol achieves this by rebalancing assets across multiple DEXs and stable-pools, ensuring efficient market-making and liquidity provision.

Benefits for liquidity providers

The Tokemak protocol offers several advantages for liquidity providers (LPs). It automates the compounding of rewards and minimizes gas costs, making it an attractive option for those looking to optimize yield generation. This automated approach reduces the manual effort required from LPs, allowing them to focus on maximizing their returns.

Security and governance in Tokemak

Currently, Tokemak is in a guarded launch phase, prioritizing security and stability through additional audits and a controlled environment. This ensures that the protocol can provide a secure and reliable platform for users. During this phase, TOKE holders have the opportunity to migrate or lock their tokens, actively participating in the protocol’s development and governance.

Governance through Liquidity Directors

TOKE holders, as Liquidity Directors, play a crucial role in the governance of the Tokemak protocol. They are empowered to direct the TVL towards different DeFi markets, influencing the distribution of liquidity and ensuring that the protocol operates efficiently.