crvUSD (CRVUSD)

crvUSD (CRVUSD) is a stablecoin launched in May 2023 within the Curve Finance ecosystem, a prominent player in the decentralized finance (DeFi) arena. This stablecoin is pegged to the US Dollar and is designed to offer stability amidst the volatile cryptocurrency market. Unlike traditional stablecoins, crvUSD is a collateralized-debt-position (CDP) stablecoin, backed by a variety of crypto-tokenized collaterals, allowing users to leverage their crypto assets while maintaining stability.

The architecture of crvUSD

Collateralized-debt-position model

crvUSD operates on a collateralized-debt-position (CDP) model, meaning users can deposit volatile crypto assets as collateral to mint crvUSD. This approach provides liquidity and maintains exposure to original assets without needing to sell them, ensuring the stablecoin maintains its peg to the US Dollar.

LLAMMA algorithm

| Ticker | CRVUSD |

| Category | Stablecoins |

| Website | https://www.curve.fi/ |

| @curvefinance | |

| Telegram | curvefi |

| Contract Addresses | |

|---|---|

| ethereum | 0xf9...4e Copied! Copied! |

| arbitrum-one | 0x49...e5 Copied! Copied! |

| optimistic-ethereum | 0xc5...f6 Copied! Copied! |

| xdai | 0xab...8d Copied! Copied! |

| polygon-pos | 0xc4...d6 Copied! Copied! |

| base | 0x41...93 Copied! Copied! |

| binance-smart-chain | 0xe2...f4 Copied! Copied! |

A key feature of crvUSD is the LLAMMA algorithm, which dynamically manages collateral requirements based on market conditions. This helps maintain crvUSD’s stability by preventing situations where collateral value might drop too low, thus avoiding liquidation. This mechanism is similar to that used by MakerDAO's DAI.

Technological foundation

Curve Finance platform

crvUSD is built on the Curve Finance platform, a DeFi protocol known for efficient stablecoin trading using bonding curves. These curves help maintain liquidity, facilitating low-slippage trading of crvUSD against other stablecoins and cryptocurrencies.

Ethereum blockchain

The stablecoin is implemented on the Ethereum blockchain utilizing the ERC-20 standard, ensuring compatibility with a wide range of decentralized applications (dApps) and wallets. Ethereum’s transition to a proof-of-stake consensus mechanism enhances both security and efficiency, aligning validators' interests with network stability.

Smart contracts

Smart contracts play a vital role in crvUSD’s operation. They enable automated, trustless transactions by embedding the terms of agreements directly into code, ensuring transparency and reducing the risk of human error or fraud.

Applications and integrations

Use in decentralized finance

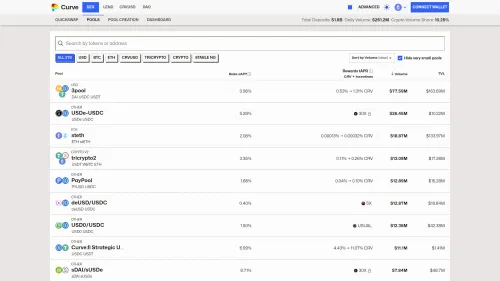

crvUSD is extensively used in DeFi activities, including yield farming and liquidity provision on Curve Finance. Users can earn rewards by supplying crvUSD to liquidity pools, thus maintaining platform stability and efficiency.

Lending and borrowing

In the lending sphere, crvUSD serves as collateral, allowing users to borrow or lend assets, thereby expanding financial services within DeFi and providing more asset management options.

Leverage trading and risk management

crvUSD is crucial for leverage trading, enabling traders to amplify their positions without exposing themselves to underlying asset volatility. It also offers a stable medium for exchanging volatile assets, mitigating risks associated with price fluctuations.

crvUSD in the DeFi ecosystem

Role in enhancing liquidity

By integrating with platforms like Ethereum, Polygon, and Avalanche, crvUSD facilitates seamless transactions and enhances liquidity across DeFi ecosystems. This liquidity is essential for decentralized exchanges and other applications.

Governance and rewards

crvUSD is tied to governance and rewards on Curve Finance, allowing users to participate in decision-making processes and earn incentives for their involvement, further embedding them into the ecosystem.

The visionary behind crvUSD

Michael Egorov, the founder of Curve Finance, is the driving force behind crvUSD. Known for his focus on stablecoin trading and his background in physics and tech ventures, Egorov is a respected figure in the cryptocurrency space. His involvement in crvUSD’s development has been well-received, with no significant controversies associated with his role.